Malaysia is embarking on a digital transformation journey by adopting e-invoicing for tax administration. As per the phased rollout planned by the Inland Revenue Board of Malaysia (IRBM), e-invoicing will become mandatory for large taxpayers from August 2024, subsequently expanding to cover all registered businesses by 2025. This major shift brings significant changes to business operations and accounting procedures.

This article explores the scope of e-invoicing implementation in Malaysia and the best practices.

Understanding Malaysia’s E-Invoicing Framework

E-invoices act as digital proof of B2B, B2C or B2G transactions, replacing traditional paper invoices. As per guidelines, e-invoices must contain 53 mandatory fields covering buyer/seller details, item descriptions, quantities, pricing, taxes etc.

Once generated, e-invoices are transmitted to IRBM for validation via the MyInvois portal or API integration. The seller then shares the verified e-invoice embedded with a QR code to the buyer.

Assessing E-Invoicing Preparedness

To prepare for this evolution, an e-readiness assessment is vital spanning aspects like:

- Evaluating existing system compatibility for integration

- Training employees on e-invoicing

- Communicating with stakeholders

- Studying e-invoice format guidelines

- Appointing cross-functional teams for the project

Choosing Suitable E-Invoicing Software

While IRBM’s MyInvois portal suffices for small volumes, API integration is ideal for larger companies to enable real-time generation and transmission. The right e-invoicing software also provides functionalities like QR code printing, detailed data validations and analytics.

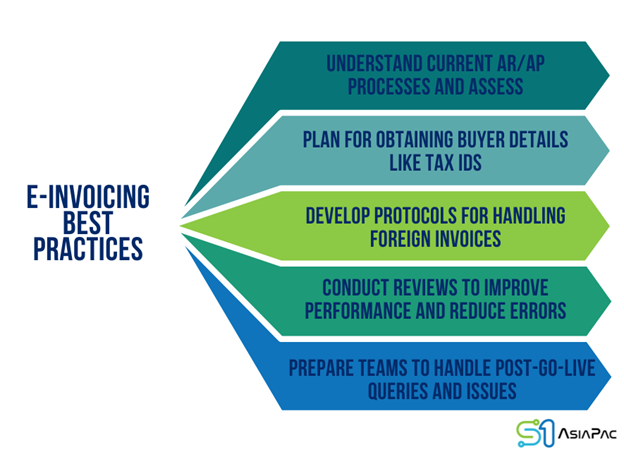

E-Invoicing Best Practices

Successfully embracing e-invoicing requires a focus on non-technical factors as well:

The Road Ahead of E-invoicing Malaysia

Though e-invoicing poses challenges around regulatory compliance, data security, system upgrades etc., its long-term benefits outweigh the initial costs for Malaysian businesses. With sound planning and methodology, companies can leverage e-invoicing as a catalyst for growth rather than an obstacle.

Conclusion

As a leader in e-invoicing solutions, we at S1AsiaPac are the ideal partners for a smooth transition. We offer seamless integration with our ERP systems, ensuring compliance with IRBM guidelines. With real-time invoice generation and transmission, data validations, analytics dashboards and maximum uptime guarantees, we empower businesses to adopt e-invoicing effectively.

Our dedicated account managers also provide end-to-end guidance and support. By opting for our customizable modules integrated into existing ERP software, enterprises across sectors can embark on a hassle-free e-invoicing journey.

Very good https://is.gd/tpjNyL

Good https://is.gd/tpjNyL